Millennials finding it tough to bounce back from Great Recession

Posted On June 16, 2018

We grouse about their participation trophies and helicopter parenting. We stereotype them as overly entitled and self-absorbed. We laugh about their reactions to pop culture standards from before they were born. But instead of mocking millennials, we should perhaps be worried about them. A new study from the Federal Reserve Bank of St.Louis found that many millennials have never gotten over the Great Recession of the late 2000s. The study found that the net worth of a typical family whose head was born in the 1980s, the front edge of the millennial generation, was 34 percent below expectations, and lost… Read More

Categories: Blog, Financial Services, Generation Y / Millennials, WealthDemystifying your paycheck: Who FICA is and why he’s taking your money

Posted On June 6, 2018

During an NBA career that spanned two decades, Shaquille O’Neal made more money per season than most of us will ever see in our lives. But when he got his first paycheck, he had a revelation with which most of us can relate: “Who the hell is FICA?” he famously asked. “When I meet him, I’m going to punch him in the face.” Michael Roe had a similar revelation, visiting his manager’s office after receiving his first paycheck to complain about being shortchanged. The experience inspired Roe to educate himself about personal finance and ultimately to create The Financial Millennial… Read More

Categories: Financial Services, Podcast, WealthSetting up a Self-Directed IRA? You Really Need to Know These 5 Things

Posted On May 23, 2018

One of the pieces of research we cite the most is the lack of Baby Boomer retirement savings, especially in the younger half of the Boomers. This lack of savings has many implications from their longevity in the workplace to Gen X’s inability to get promoted. Today I’m posting a guest blog from Rick Pendykoski about a self-directed IRA – a type of retirement savings tool. If you’re a Boomer and haven’t begun retirement savings, maybe this is the right one for you. -Cam If you are setting up a self-directed IRA to expand your financial portfolio beyond stocks and bonds,… Read More

Categories: Financial Services, RetirementDealing with the mid-career doldrums: Is it time for a change?

Posted On April 12, 2018

Are you tired of your job? No, I mean really tired – to the point of throwing away a career of twenty-some-odd years and starting over? You may be suffering from a fairly common phenomenon I call the mid-career doldrums. You’ve been doing the same job for a couple decades, you’re bored, and the achievements that once thrilled you don’t move the needle for you anymore. You crave something new, but stepping away from the familiar into the unknown can be scary. Can you make the leap? Should you? My guest in this episode of “What’s Working With Cam Marston”… Read More

Categories: Financial Services, Generation X, Podcast, WorkWho argues over money the most? (Spoiler: It’s not the kids, and it’s not the grandparents)

Posted On March 24, 2018

They are in their prime earning years, old enough to have moved into management positions but young enough to not be staring directly at retirement just yet. And yet, perhaps moreso than any other generation, Gen-Xers are stressed about money. In a story initially published by LearnVest, Forbes contributor Julia Chang cited a CompareCards poll that found more Gen X couples argue about money than Baby Boomers or millennials. Twenty percent of the Gen-X couples surveyed in the poll said they’d sparred over finances within the last month, compared to 17 percent of millennials and only 9 percent of Baby… Read More

Categories: Financial Services, Generation X, WealthStock market losses leave sour taste for millennial investors

Posted On February 19, 2018

Play the stock market, they said. It’ll be fun, they said. According to a recent piece in the New York Times, the recent volatility in the market may have some millennials ready to get off the ride – or at least ask it to slow down. Data shows millennials typically consider themselves cautious investors. The Times cited survey data from Legg Mason showing that only about one-third of them own stocks and more than 80 percent of them consider their investment strategies to be “conservative.” Despite all that, millennials’ expectations may be a little too bullish. The Times cited a… Read More

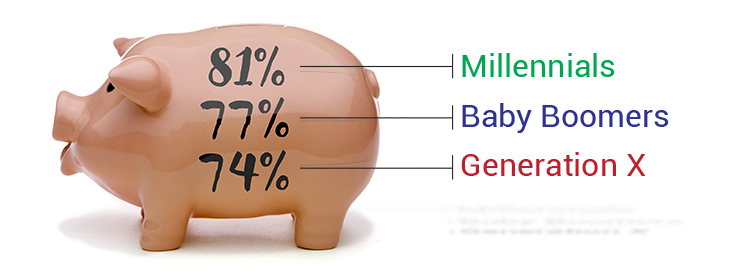

Categories: Financial Services, Generation Y / MillennialsWho’s the best at feeding the piggy bank? You might be surprised.

Posted On January 21, 2018

Quick question: Which generation would you think is doing the best at saving for the future? Baby Boomers? They’re the closest to retirement, and therefore the benefits of saving should be most immediate to them. Generation X? They’re in their peak earning years, and should have the most resources from which to feed the piggy bank. Either would seem to make sense, and either would be wrong. According to a new Discover Bank survey shared on Nasdaq.com and elsewhere, it’s millennials who are doing the best job at saving. In a nation study of over 2,200 people, 81 percent of… Read More

Categories: Financial Services, Generation Y / Millennials, WealthThe good, the bad, and the … stay tuned!

Posted On October 2, 2017

This week the Federal Reserve released the 2016 Survey of Consumer Finances (SCF). The SCF is one of the largest (over 6,000 households were interviewed for the 2016 survey), comprehensive and representative surveys to track patterns of household spending, income, wealth and investment. Conducted every three years since 1989, the SCF provides analysts – including demographics geeks like us – a treasure trove of information. You might have already seen news stories documenting things like educational and geographic differences in income. One of the big questions being asked this time around is whether or not household wealth has recovered to… Read More

Categories: Financial Services, Generation X, WealthBoomers: One Generation, Two Different Animals

Posted On September 20, 2017

They say you can never stop learning. If you’re a financial adviser, you should strive to prove that theory. One of the important things we need to keep re-learning is how different generations prefer to handle their money — or even different subsets within the same generation. Many advisers, for instance, may think they know all there is to know about Baby Boomer clients. Many advisers are Baby Boomers themselves. But there are important differences to consider even within the Baby Boomer generation. While many leading boomers, born from 1946 to ’55, are already retired, trailing boomers who were born… Read More

Categories: Baby Boomers, Financial Services, WealthHow Long Does Your Generation Shop for Homes?

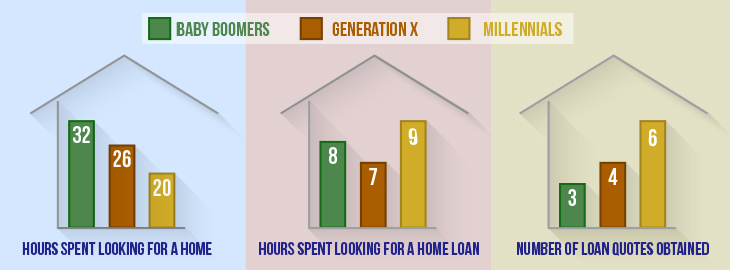

Posted On October 11, 2016

(Special Blog today comes courtesy of Zillow who researches generational trends on their users and homebuyers across the market place.) By Jennifer Riner Every generation offers specific trends, habits and lifestyles that sets them apart from their predecessors. Much like Generation X differs from their Baby Boomer elders, Generation Y thinks outside of the box when it comes to finding their perfect homes. A recent Zillow survey conducted by Ipsos of 2,010 American adults revealed how home and mortgage shopping trends differ across age groups. Regardless of generation, the average American spends 26 hours finding their perfect place and just… Read More

Categories: Financial Services, Generations, Real Estate