Middle Child Syndrome of Gen X

Posted On June 29, 2016

“Marsha, Marsha, Marsha!” Most Generation Xers know exactly where that phrase came from and who said it – Jan Brady on the Brady Bunch. With her whiny lament for attention and jealousy of her sisters, Jan came to be a symbol of the archetypal middle child. In the generational household, it’s Generation X that is playing the role of Jan Brady, stuck between the bigger Baby Boom generation and the up-and-coming millennials. In a recent Forbes article, Cynthia Meyer notes that Gen-Xers are often overlooked when it comes to financial security, their concerns wedged between the impending retirement of the… Read More

Categories: Financial Services, Generation X, WealthGeneration X isn’t doing well at this preparing for retirement thing.

Posted On November 2, 2015

Forbes recently cited several surveys and polls that found Gen-Xers falling behind with or completely ignoring their financial futures. A Harris poll commissioned by the Transamerica Center for Retirement Studies found that 25 percent of the Gen-Xers it surveyed had no sources of information for retirement and 45 percent didn’t even want to think about it. Forty-six percent of the Gen-Xers surveyed by Allianz Life in May were essentially playing it by ear until they hit retirement age. A Northwestern Mutual report found that 82 percent of Gen-Xers don’t believe they’ll be able to retire comfortably and 18 percent don’t… Read More

Categories: Financial Services, Generation XMillennials Fiscally Responsible

Posted On September 8, 2015

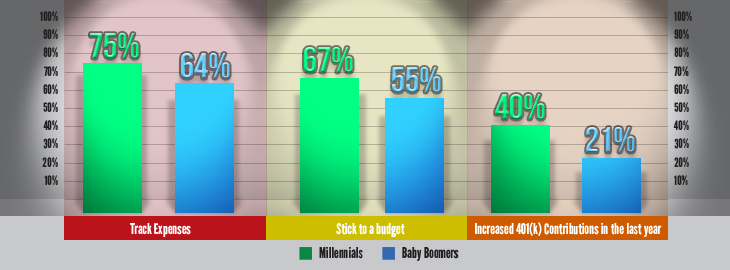

Last time, we looked at the benefits of financial benefits of millennials spending a couple extra years at home after leaving college. Now, Forbes tells us that millennials may be way ahead of the rest of us in terms of fiscal responsibility. The magazine recently noted a T. Rowe Price survey that found millennials doing a better job of tracking their spending, sticking to a budget, and even taking advantage of things like 401(k) plans. Among the survey’s findings: 75 percent of millennials surveyed say they track their expenses carefully, compared to 64 percent of Baby Boomers. 67 percent of… Read More

Categories: Financial Services, Generation Y / MillennialsAre you saving enough?

Posted On July 28, 2015

Are you saving as much as you should be for retirement? If you’re a typical American – and particularly a typical American millennial – probably not. A recent study on retirement saving and spending by T. Rowe Price found that millennials are saving an average of only 8 percent of their salary for retirement, just over half the recommended 15 percent. In light of this, the Fiscal Times offered strategies for millennials to increase that figure. Most of them are common-sense things that apply to people of all ages – cutting costs, budgeting and prioritizing expenses – though many millennials… Read More

Categories: Financial Services, Generation Y / Millennials“Tell me again how good we have it, Dad?”

Posted On July 21, 2015

If you feel like you’re making more but have less, you might be Generation X. According to this report from Stony Brook assistant professor of finance Noah Smith, writing for Bloomberg View, the Pew Charitable Trusts tracked Generation X households like mine and found that we typically make about $12,000 more than our parents at the same age, adjusting for inflation and household size. That’s the good news. Now for the bad: Less than half the Gen Xers in every income bracket are wealthier than their parents at the same age. Part of that, of course, is that we’re spending… Read More

Categories: Education, Financial Services, Generation X, WorkGen X – a financial conundrum

Posted On September 30, 2014

For years we’ve been talking about how Gen X is going to be the first generation that is not expected to be better off that its parents. Sometimes Gen X is given a slightly better chance and that dubious honor is bestowed on the Millennials. Either way, the trickle down economics don’t seem to be happening past the Boomers. Which is why the latest research from the Pew Charitable Trust I so intriguing. As reported in The Washington Post, a new study shows that Gen X is actually making more (adjusted to 2011 dollars) than Boomers did at the same… Read More

Categories: Financial Services, Generation X, WealthRetirement across the generations: Outlooks and warnings

Posted On September 11, 2014

It’s generally accepted that individuals will need retirement savings of roughly 16 times their pre-retirement salary, and that social security will cover only 4 times salary at most. It is also generally understood that most individuals cannot count on employer-defined plans to fund that missing 11 times salary – but how much is very different by generation. An Aon Hewitt study reported in Benefits Quarterly predicts that Boomers will be responsible for generating roughly 6.3 times salary out of their own savings while Millennials are faced with a daunting 10.5 times salary gap. The upside, of course, is that Millennials… Read More

Categories: Financial Services, Generation Y / Millennials, Retirement, WorkplaceAdvisors: May the odds be ever in your favor

Posted On September 4, 2014

For every two retiring financial advisors, only one is joining the ranks. And despite the rise of e-trading and self-directed investing, that ratio is not for a lack of jobs. Young professionals with financial degrees are simply choosing other career paths. I’ve written about this hot topic multiple times, but am always interested in others’ perspectives. Cyrhil Tuohy wrote an article that I thought brought an interesting twist to the conversation. In his piece for InsuranceNewsNet.com,Wanted: Financial Advisors For Generation X Tuohy brings together the dearth of younger advisors with burgeoning need from Generation X – the generation next in… Read More

Categories: Financial ServicesInvesting for the next generation

Posted On August 21, 2014

Financial advisors are struggling to find the best way to connect with young investors. According to Forbes, younger generations are taking matters into their own hands – creating businesses that adapt to the Millennial way of thinking. These savvy entrepreneurs are taking the principles of DIY investing and marrying them to financial advisory to recreate the investment experience so that it mirrors the values of the younger generations. Wealthfront, an investment company highlighted in the piece, offers a “refer-a-friend” bonus that comes in the form of an increased cap on the assets managed at no cost. While older generations would… Read More

Categories: Financial Services, Generation Y / MillennialsCan early financial literacy indicate future success? If so, look out.

Posted On July 24, 2014

According to an international report on financial literacy, recently released by the Organization for Economic Cooperation and Development, today’s teens are ill-equipped to make much more than basic spending decisions. And this could be a problem. Financial planning demands are increasingly complicated. While Matures, and to some extent Boomers, were able to supplement pensions and corporate retirement plans with some personal financial planning, Xers, Millennials and iGen know that they are on their own. But has education kept pace with needs? It seems not. The OECD report indicates there is work to be done, with more than 1 in 6… Read More

Categories: Financial Services, iGen, Wealth