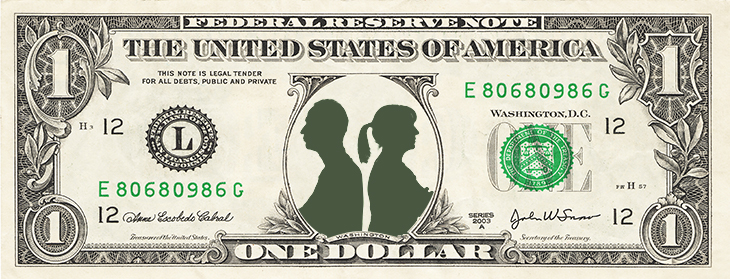

Who argues over money the most? (Spoiler: It’s not the kids, and it’s not the grandparents)

Posted On March 24, 2018

They are in their prime earning years, old enough to have moved into management positions but young enough to not be staring directly at retirement just yet. And yet, perhaps moreso than any other generation, Gen-Xers are stressed about money.

In a story initially published by LearnVest, Forbes contributor Julia Chang cited a CompareCards poll that found more Gen X couples argue about money than Baby Boomers or millennials. Twenty percent of the Gen-X couples surveyed in the poll said they’d sparred over finances within the last month, compared to 17 percent of millennials and only 9 percent of Baby Boomers.

Chang astutely notes that despite their earning power, Gen X is at an age where money gets tight, with mortgages and the costs of raising children competing with saving for retirement and the shadow of upcoming college tuition costs hanging over them – if they don’t have a child in college already. Some, she adds, are also having to deal with caregiving costs for their elderly parents.

Let’s also look at where the other two generations are – Baby Boomers are either already retired or can see that day clearly from where they are. What do they have to fight about, other than which retirement community to join or where to winter as a snowbird? Millennials are just getting started, and as many have waited much later than their parents to tie the knot, the honeymoon period may not even be over.

It is Generation X that’s in the dreaded middle age sweet spot, young enough to still have more than two mouths to feed and old enough to have heard their significant other’s excuses for that $1,000 golf weekend just four or five too many times.

While the financial pressure can be high, Chang notes that communication may be the key to avoiding the arguments. Over a third of those surveyed by CompareCard said they had hid purchases from their spouse, and 10 percent admitted to having a secret credit card.

Those new outfits in the closet or that new driver in your bag may cause a spat if you aren’t quick enough to grab the credit card statement from the mailbox before your spouse, whereas perhaps a discussion beforehand about why those purchases were important might have avoided it. Trust is important in any relationship. No one likes to be deceived.

Here’s another way to avoid arguing about money: Challenge yourselves to spend less of it. Talk with your spouse about your financial situation in big-picture terms – where you are and where you want to be – and not in the context of a specific decision or purchase. Set mutual goals and work toward them together. Eat out a little less, wear last season’s clothes a little longer, and put a little more toward your retirement. Then one day, if you can both commit yourselves to it, you’ll be able to winter wherever you want.